Dipchand LLP is proud to share our support and participation in artist and activist Benjamin Von Wong’s latest project and symbol of environmental change, the Giant Plastic Tap.

Dipchand LLP is proud to share our support and participation in artist and activist Benjamin Von Wong’s latest project and symbol of environmental change, the Giant Plastic Tap.

In collaboration with the Embassy of Canada in France, Von Wong continues to raise the awareness of single-use plastics, but for the first time, his art directly tackles the source of plastic pollution -its production.

To help amplify the movement, Von Wong created an opportunity for everyone to participate in the project and help #TurnOffThePlasticTap through a $10,000 giveaway in prizes.

Our lawyer Dan Pollack worked closely with Von Wong and his team to create the necessary agreements, rules, and releases to bring this project to life. The following breakdown discusses the various legal components that are an essential behind-the-scenes part of this spectacular installation and giveaway.

(The Giant Plastic Tap in an active container yard featuring Benjamin Von Wong’s mother posing as a construction worker.)

The Giant Plastic Tap –Art Installation

Releases and Terms & Conditions:

- Property/Location Releases

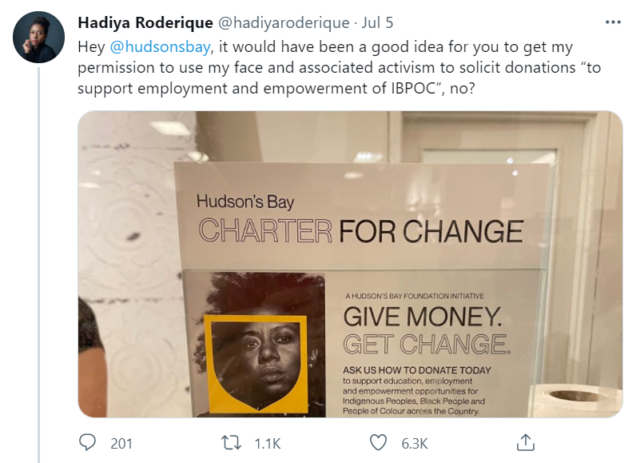

- Production/Media Releases

- Model Releases

- Contributor Terms

- Terms of Use for Users (individuals, media, NGOs, and businesses)

Contest

Creating official contest rules with a “short rule” summary Contest Platform

- Gleam.io

Gleam.io is a third-party marketing platform used for running various campaigns with an app that allows you to track and monitor your competition on the platform, social media, and your website.

Von Wong uses Gleam.io to allow the audience to complete a variety of tasks, including sharing the contest link, creating mash-ups, and watching videos to increase their chances of winning a prize.

While Gleam provides excellent tools for this kind of campaign, it’s still vital to ensure that the applicable terms and contest rules are customized to your needs and properly vetted.

(Remixed photo by Ted Chin for the #TurnOffThePlasticTap campaign -IG Account: @TedsLittleDream)

(Remixed photo by Ted Chin for the #TurnOffThePlasticTap campaign -IG Account: @TedsLittleDream)

Promotion

- Social Media Platforms

Social media is one of the easiest and most impactful ways to reach and engage with your audience. However, when it comes to sponsoring promotional campaigns, you need to consider the legal regulations and restrictions unique to each social media platform.

To run a successful campaign, it’s essential to make sure you understand each platform’s policies, or you run the risk of penalties such as takedowns and even possible account suspension or termination.

You can find the rules for some of the top platforms here: Facebook, Twitter, and Instagram.

Remember, to run a successful campaign of any kind it’s essential to have your legal ducks in a row with the correct documentation and to review the policies of all the platforms you’re using. While this due diligence can be daunting, it’s a critical step to avoid potentially serious legal headaches in the future.

We’re very excited to share Von Wong’s Giant Plastic Tap initiative and the contest with you and wish everyone the best of luck! For more information on the Giant Plastic Tap and the $10,000 giveaway in prizes, please visit https://www.turnofftheplastictap.com/.